The New Era of Investment “LIQUIDITY”, “DEX”, “DeFi”

Table of Contents

The New Era of Investment “LIQUIDITY”, “DEX”, “DeFi”

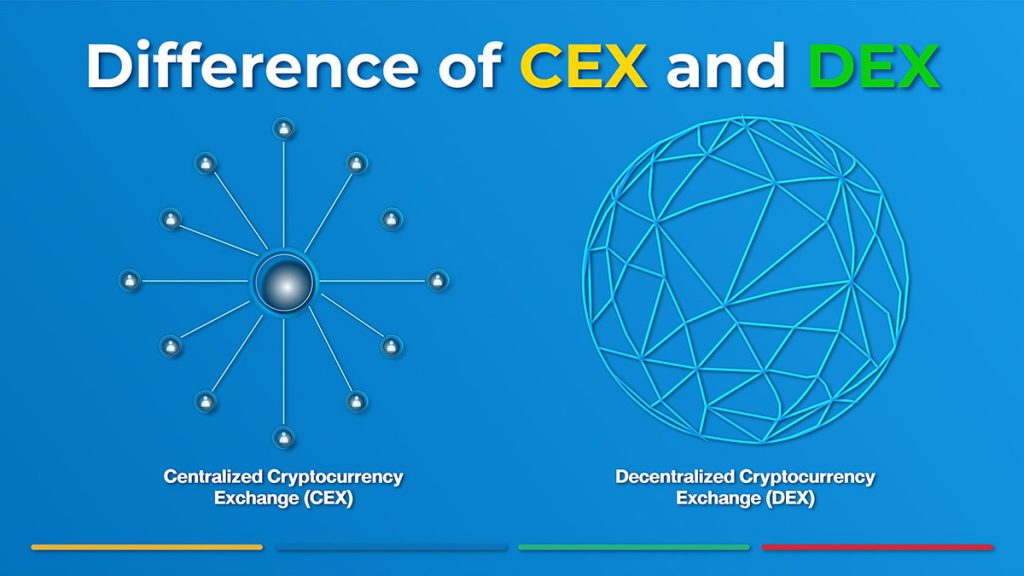

The rise of blockchain technology has divided the exchanges into two types. And these exchanges have their own pros and cons in the financial economy. In order to understand the difference between a centralized and decentralized exchange hereby is the brief scope of what they really mean.

Why Do We Need a Refine for Financial System?

DeFi essentially represents a broad category of financial platforms built on public blockchains. It refines and reverses the traditional financial system completely.

Combines protocols, tokens, and smart contracts to provide financial accessibility to individuals, (mostly) without the need for traditional banking channels. Some of the services currently offered in the DeFi space include exchange, payment processing, funds, and lending/borrowing.

Centralized exchanges (CEXs) are a type of cryptocurrency exchange that is operated by a company that owns it in a centralized manner. On the other hand, decentralized exchanges (DEXs) are executed on the blockchain (distributed ledger) technology.

In this way, DEX does not hold customers’ funds, positions, or information and only routes the orders of trading to a matching layer.

What exactly is the part of CEX causing the dissatisfaction that led to the development of DEX? From the forum Centralized Exchange (CEX) – Old-Fashioned But Still Strong has its own contradiction in its narration.

The centralized exchange also forces traders to deposit funds in the exchange. This makes it easier for exchanges to manage funds in bulk, but the customer has no control over their funds. The customers may not be able to withdraw when they want to, or may not even receive their assets when the exchange is hacked.

They further say that transactions on DEXs are slower, but it comes with blockchain on the backend with a stronger security system, granting authoritativeness to the owners, and it is a peer-to-peer operation.

Key differences:

Centralized Exchange

– Depositing fiat money (debit/credit) or cryptocurrencies.

– Giving up control over that amount of currency.

– Do not own the private key to the money.

– Work on an order book and the transactions are done using the exchange’s own database.

– Faster and no delays.

– Comes at the price of independence: you have to trust the exchange with your money.

Decentralized Exchange

– Invest in cryptocurrencies.

– Owns the private key to the cryptocurrencies.

– Full control of your money.

– Executes on the blockchain with smart contracts.

– Manageable on every transaction and depositing amount.

– Comes at the price of dependence: non-custodian, flexibility, and traceability.

Borrowing and Swapping Currencies (DEX)

Let’s talk about in real life situation when you needed to borrow some money from someone you know, first you have to know if he or she has the amount or the currency that you want with them or not.

If the lender does not have that amount of money or specific currency you need this situation equals to the lacking of liquidity.

In fact it is similar to the decentralized exchange where, this exchange is well known in the title “swap” hence the swap protocol on many DeFi platforms for example Uniswap, PancakeSwap, SushiSwap, etc.

The sub-section of DEX is swapping which originally occurred on the Ethereum chain. It allows users to seamlessly exchange or swap tokens in hosted pools and offers yield farming incentives to liquidity providers.

This is the advantage of practicing decentralized exchange in cryptocurrency where users do not have to worry about the liquidity of the currency in which they need for an exchange. The currencies are stored on the respective pool and blockchain of each platform ready to be used in the exchange activities.

Usually, users are attracted to be the liquidity provider with beneficial returns. By providing the cryptocurrencies to the pool users “sell” the currency they own and receive yield as a return.

In the exchange under a decentralized network, users are able to swap the pairs of tokens supported in the specific chain (e.i. ERC-20: DAI for ETH). The key benefit of swapping in DeFi is that it is noncustodial.

The assets can be customized in a smart contract with the rights of asset owners that can be exercised at any time and is only complete when the exchange conditions are agreed to and met by all parties. If any condition is not met, the entire transaction is canceled.

Yield farmers are incentivized for provisioning liquidity or providing other value-added services to a decentralized application’s ecosystem. Yield farmers are paid with pro-rate in native governance token, granting the user a higher Annual Percentage Yield (APY) on their provisioned liquidity.

Summary

DEX and the liquidity pool share their relationship on the DeFi system and cannot stand alone. It probably is the new way to get involve in the decentralized finance investment to harvest income passively with an interesting return rate.

Lastly, SIX Network is about to launch the newest, biggest project ever on the DeFi space wherein this hour no one hasn’t heard off. SIX wanted to emphasize and encourage everyone to trade with the advancement of knowledge material and with confidence.

Our participation in recreating the DeFi platform for the decentralized exchange and investing fund is the mission to help investors whether beginning or expert level to trade on our platform without the hassles with the help of experts.

Napathsorn Unchit

Passionate about financial world and is an inverstor too! Giving out news update and blog post every month.

Visit us at SIX Network for more.

Related Posts

Bitcoin Halving Countdown with SIX Network

Get Ready for the Bitcoin Halving Day! Counting down just 2 days with SIX Network before we reach the historic

SIX Network Announces Strategic Partnership and Investment in ContributionDAO

SIX Network, a leading blockchain for businesses, announced a strategic investment and partnership with ContributionDAO, an institutional graded blockchain infrastructure

SIX Network Roadmap 2024: Ready to Ride the Big Tide

2024 is an exciting year, with major events and trends set to occur. The approval of the Bitcoin ETF has

SIX Network: 2023 Year-End Highlights

As we conclude 2023, this blog provides a concise yet thorough summary of our achievements and strategic efforts throughout the

SIX Network Q3 2023 Summary

Table of Contents Introduction Welcome to the Q2 2023 recap of SIX Network. This quarter, SIX Network has made impressive progress

SIX Network Amplifies the Capabilities of Digital Assets for BNK48 16th Single Senbatsu General Election

SIX Network, a leading blockchain solutions company, Introduces digital assets for the upcoming BNK48 16th Single Senbatsu General Election, aiming