SIX Network – Job Openings

At SIX Network, we’re constantly seeking ways to develop the best initiatives in the crypto space. Launched in 2018, SIX

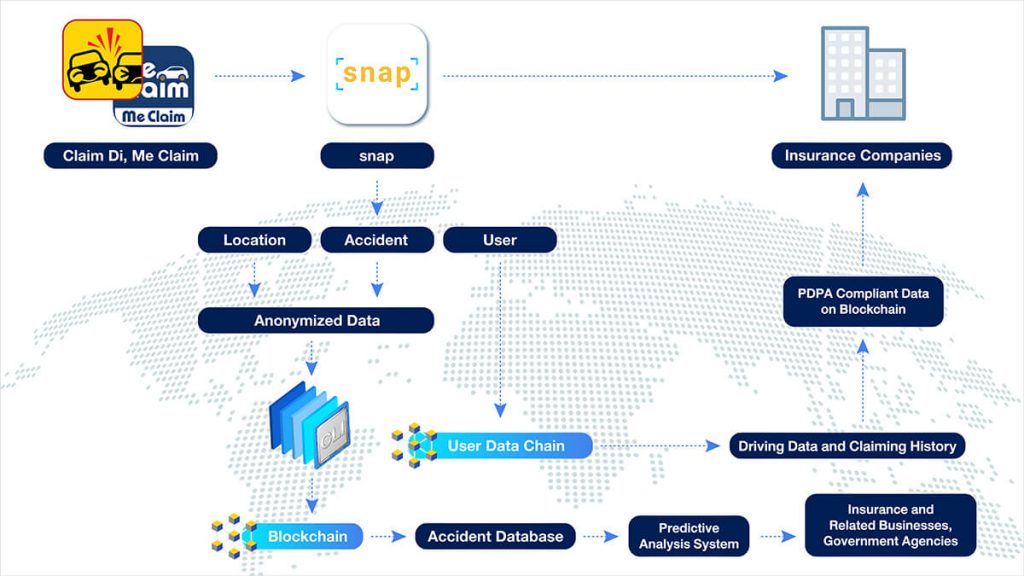

SIX Network with smart digital insurance platform, Claim Di, is revolutionizing the digital economy-oriented blockchain to a decentralized system for peer-to-peer.

1. New Secure Technology – The emergence of blockchain technology has stirred the trend for digital insurance platforms that want to segregate their service from a democratized system.

‘Snap’ powered by SIX Network and Claim Di by Anywhere 2 Go conjoined tomake the insurance system become more secure and transparent.

2. Reduce Fraud – Adopting ‘snap’ technology into the digitization system of the insurance sector makes a big difference by reducing any potential scammer, modified images during the process of inspection.

The algorithm used in the blockchain of the ‘snap’ application helps reinforcing traceability and transparency of the visual inspection composition of a photograph captured by phone or camera.

On the other hand, Claim Di provides the fastest and easiest insurance claim on the tip of your finger. No need to waste time waiting for surveyors to do an inspection at the roadside accident.

The application will notify the insurance company instantly and store up the data into their central database for further inspection and process.

3. Reduce Administrative Cost – Through the automated verification of claim and payment through what known as smart contract. The task and automation process execute more seamless processes and lower the cycle time.

4. Applicable to Many Industries – The real use case example of blockchain leverage in its respective industry is proven to be useful for more than doing crypto transactions.

Insurance tech firm from Munich, Germany Etherisc has been involving blockchain into its system to create a new era of purchasing and sale of insurance efficiently. One product line that needs a precise calculation of the loss and profit for claimants is Crop Insurance.

With the Crop Insurance Application, users are enabled to select their crop location and product of their field to issue the insurance policy. In the case of calamity damaged, clients get an automated instant payout.

Blockchain technology allows Etherisc to check GPS and weather station data based on the location, then cost-effectively calculate the risk and contract terms. Decentralized insurance leveraging blockchain is practical in the real world.

Not only is it faster and money saving for the insurer, but eliminates the human error of potential fraud while streamlining the claim payments.

5. Advantages – High security, transparency, and immutability are the key factors why blockchain is an advanced technology that helps people reach out to stable facts and true to the condition all the time.

When an order of any transition is requested on the blockchain, it requires a personal key to take action and to sign acknowledgment. This key is known by one single individual to prevent a tampered attempt.

The collaboration of two giants in its respective sector has signed a Memorandum of Association (MoU) by utilizing blockchain technology into the insurance system.

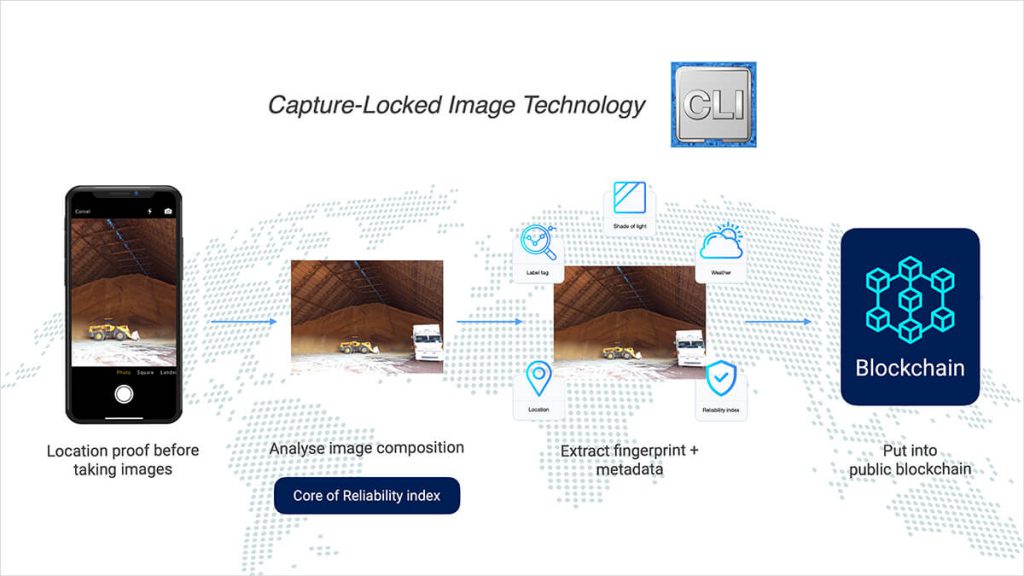

Thailand’s InsurTech, Claim Di has adopted the Captured-Locked Image (CLI) from its in-built ‘snap’ application to eliminate the chances of image manipulation.

Allowing for evidence-based imaging at the roadside accident scenes such as location, image surrounding to instantly analyze the details of a photograph.

The services Claim Di provides for clients collaborating with ‘snap’ are:

• Claim Di – Smart digital insurance application that will alarm the client’s insurance company about the claim directly.

• Police i lert u – Notify the nearest police station if the accident needs law enforcement.

• Me Claim – Suitable when clients need both an insurer and police officer for the accident to occur.

Claim Di platform has been providing full service and conjoined all parties that are involved for any incident claim over 3,000,000 cases annually:

• 12,500 Claim Di Bike agents in every region throughout Thailand.

• 50 Trusted Insurance Company

• 200,000 Police Officers on duty

• 1,483 Police Stations

• 24hrs Bangkok Hospital (BDMS) and its affiliated hospitals stand-by

Aims to make the claiming process much smoother, faster, and less vulnerable to fraud where blockchain acts as the indicator for evidence approval and information storage.

Reduces time of claiming process. No need to waste time on waiting for the surveyor to come to the accident scene.

The client can make a car inspection by themself if there are small scratches from accidents or no major damage to the vehicle. These picture approval can be used for renewing car insurance policy.

Information stored in the system can be sent to the relevant department to improve the scenery of the area to reduce the cause of accidents in the future again known as Predictive Analysis.

Besides data storage and management on the blockchain, ‘snap’ can help segregate data ownership and create a database of drivers in the insurers’ portfolio.

To be more specific, the insured or the drivers can permit the platform to use vehicle inspection and claim history as well as the driving profile of the insured.

The digital insurance provider can use such information to provide reasonable and fair insurance premiums to the insurer

Thailand InsurTech has foreseen the big opportunity to create a digital economy for the community.

Involving blockchain technology will enhance the ability to store useful information and validate any data that is uploaded to the system to mitigate the risk of tampering fraud or cyber scams.

1. How did SIX Network technology improve the facility of Claim Di?

“SIX Network has been providing a module of significant space for information management and storage of the images from the claimant. Assuring the insurers to calculate loss and payout profit to its client precisely.”

2. What has Claim Di application brought to their clients?

“We provide a fast and secure application for users to easily understand the use and directly contact the insurance company without no time wasting to wait for the surveyors to come to the accident scene.”

3. What is the thing you needed SIX Network to develop in the future to help improve Claim Di application?

“We want our clients to know that the storage system of Claim Di application is on blockchain which will ensure the trustworthiness of the application to the users. Also that we want to make sure that the users can retrieve their own data such as personal profile and images. Now our users think that the app runs their phone camera and is sending the image via the app to the insurer with no database.”

4. What is the position of ‘snap’ on Claim Di application?

“‘snap’ position here is to prove the authenticity of the images taken on real time events by accessing the data based on the weather, condition, sun azimuth, lighting shade, etc. and calculate to find proof to reduce scamming claims for profit. After the calculation the images are stored on the blockchain with no access from anyone to make change.”

5. Who is suitable to use Claim Di and in the future do insurance companies still need their surveyor team?

“Claim Di is designed for end-to-end users so that it is fast for every relevant part to take action on the accident claim. Insurance companies still need their surveyor team, inhouse or outsource, to take part of the inspection. This is because when there is a major damage or accident with a litigant, clients could not decide on their own whose fault it was according to law. But we are emphasizing the use of application on minor damage that they can do car inspection via this app without the surveyor, it is easy and fast.”

The insurance of tomorrow is seamingly becoming true in the nearest future. Many parts of the world is promoting the smart digital insurance trend and foremost the blockchain technology into their basis activity.

The route for a digital insurance is a long hual including parties from government and technology stacks to bring about the small and large business behind a common ecosystem interest.

Keeping up with us at SIX News & Updates

Passionate about financial world and is an inverstor too! Giving out news update and blog post every month.

Visit us at SIX Network for more.

At SIX Network, we’re constantly seeking ways to develop the best initiatives in the crypto space. Launched in 2018, SIX

“Will you be able to learn how to design UX/UI on your own?” “This will be very new for you!”

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |